Reposted from Alexander Holburn Beaudin + Lang LLP

An independent contractor is a self-employed worker who serves clients through the contractor’s own business. This status is distinct from that of an employee, who provides services to an employer as part of the employer’s business.

Employment law treats independent contractors and employees very differently. Employees enjoy greater legal protections in the workplace, and employers have greater legal duties toward workers classified as employees. Independent contractors and their clients are left relatively free to negotiate the terms of a working relationship as they see fit.

In some circumstances, it may be difficult to determine whether a worker is considered an employee or independent contractor. While there is not a single conclusive test to determine whether a worker is an employee or an independent contractor, the courts generally consider the following non-exhaustive factors when making a determination:

- The level of control the employer has over the worker’s activities;

- Whether the worker provides their own equipment;

- Whether the worker hires their own helpers;

- The degree of financial risk taken by the worker;

- The degree of responsibility for investment and management held by the worker;

- The worker’s opportunity for profit and the performance of their tasks.[1]

These factors constitute a non-exhaustive list, and there is no set formula as to their application. The relative weight of each factor will depend on the particular facts and circumstances of each case.[2]

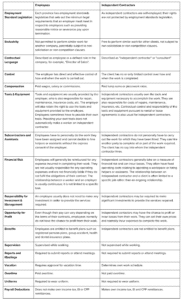

To help you better understand the differences between independent contractors and employees, we have prepared the following chart listing the different characteristics between the two:

DEPENDANT CONTRACTORS

Courts and many administrative tribunals treat employment status as a spectrum, with employees at one end and non-employees like independent contractors at the other. They have also recognized a middle category referred to as “dependent contractors”, consisting of workers who cannot be considered employees but who are economically dependent on a single client company.

While the complete factors and considerations of what categorizes a worker as a dependant contractor is beyond the scope of this article, it is important to know that the determination of dependent contractor status in Ontario has been described as a two-step process:

- Determine whether the worker is an employee or a contractor based on the common law factors as described above; and

- If the worker is a contractor, determine whether the worker is economically dependent on the client in question.

Economic dependence typically results from an exclusive working relationship between a worker and a single client company. A high level of exclusivity weighs strongly in favour of a dependent contractor finding.[3]

At common law, dependent contractors are like employees in that they are entitled to reasonable notice of the termination of the working relationship, in recognition of their economic dependence on a single employer.

In most jurisdictions, dependent contractors may be granted the same rights held by employees to participate in collective bargaining and the relevant labour relations regime. Dependent contractors are expressly included in the definition of employee for the purposes of labour relations in the Federal jurisdiction as well as Provincial jurisdictions such as Alberta, British Columbia, Newfoundland and Labrador, and Ontario.

FINAL THOUGHT

Employers need to carefully evaluate the status of workers they engage and should not blindly classify a worker as an independent contractor for the sake of convenience. When engaging an independent contractor, it is important to understand the differences from that of an employee and ensure to have the appropriate independent contractor agreements in place.

An employer’s management and human resources personnel responsible for hiring and contracting workers should be adequately trained on the characteristics of an independent contractor versus an employee to ensure the worker is classified correctly.

For more information, pleas contact Michael Furyk and the Labour and Employment Law Group at Alexander Holburn Beaudin + Lang LLP.