Reprinted from Benefits By Design (BBD) blog/website dated April 19, 2022

Dental fee guides were created to help Canadians across the country have access to reasonably and competitively priced dental services. They influence employee benefits plans by helping to shape how much insurers will reimburse plan members for services. They also have an impact on the price of group dental premiums.

What is a Dental Fee Guide?

A dental fee guide provides recommendations for the pricing of various dental services. It is not a compulsory price listing, but rather a guide for dental practices to use in setting their fees each year. Provinces have their own dental fee guide, and they are updated and released on January 1st each year. Dentists are not obligated to use these guides, but it is in their better interest to do so, as we will explain below.

Why Do We Have Dental Fee Guides?

You might be wondering if they are not mandatory, why do we need them?

Competitive and Fair Pricing

In order to ensure that their prices remain competitive, dental practices can use the fee guide as a benchmark. This way, they do not lose customers by overpricing their services. It also keeps the fees fair, since most dentists in a particular province will keep their pricing close to the recommended fees, and prices do not skyrocket.

Until 2018, Alberta had not had one for 20 years. Prices and claims for dental services were the highest in Canada. In order to tackle this issue, the fee guide was reintroduced, and the results have been mostly positive.

Demographics and Geography

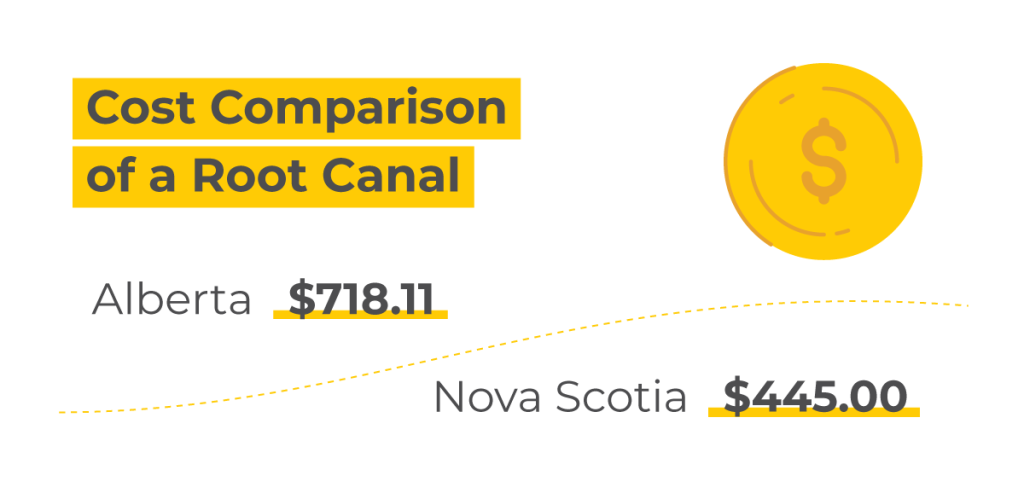

Each province has different demographics, and therefore, where a dental practitioner is doing business is important to how much they should charge for services. Thus, provinces provide a separate dental fee guide. For example, in Alberta, an uncomplicated Root Canal on a permanent tooth with only 1 canal has a suggested price of $718.11. Whereas in Nova Scotia, the same procedure is only $445.00.

How Do Dental Fee Guides Affect Group Benefits Plans?

A change in the price of a dental service fee will directly impact group benefits plans whose members use these services. If the cost of an average dental cleaning goes up, and 20 employees get a cleaning twice a year, the benefits plan will be paying those extra costs.

Insurers Reasonable & Customary (R&C) for Dental Based on Fee Guide

Insurers also use the dental fee guide to set their Reasonable & Customary (R&C) amounts. These are the standard or average costs for a particular medical service or supplies in a specific geographical area. If dental fees are set higher than the dental fee guide, and therefore higher than the Reasonable & Customary amount, plan members will be paying out-of-pocket for any amounts above the R&C. Eventually, patients will shop around for a dentist whose fees are more in-line with those amounts.

Group Insurance Premiums and Renewals

Insurers and dentists alike will find it in their best interests to allow this balance to continue. Without a dental fee guide to base their prices on, dentists could essentially charge however much they chose. Higher dental fees mean individual claims are higher. This leads to higher dental claims totals. In turn, this affects your overall claims experience (it goes up) for dental. Eventually, that could mean higher premiums for you and your employees.

It’s clear that the practice of releasing dental fee guides annually helps keep prices consistent for the benefit of all parties involved. Dentists remain competitive and plan sponsors aren’t paying an arm and a leg for dental premiums. Plan members and patients benefit by not having to pay as much out-of-pocket, and insurers are able to provide dental coverage at a more reasonable cost.