In 2020, plan sponsors benefited from Covid-19 induced reductions in dental claims, that because of closed dental offices during the initial pandemic closures, resulted in an overall reduction of some -10% to -15% in claims activity. So, in 2021, the Canadian Dental Association is doing its best to help offset some of that lost revenue to its members with substantial increases in the dental fee guide this year (2021).

There is no question that operating a dental practice post Covid-19 will be and is more expensive because of PPE expenses, other infection control measures and perhaps the ability of practitioners to see less patients, because of precautions related to time between patients and settling of aerosol droplets etc…but a 4.6% fee guide increase in Ontario, in addition to a “utilization adjustment – reflecting the fact that mature plans are more heavily utilized in each successive year”, will mean that plan sponsors will face a 10% bump on claims activity, for rate/premium setting purposes. This is ontop of changes in the usual calculation of dental premium rates because of subsidies or premium holidays given to clients while dental offices were closed and plan members were unable to use their dental plans. Subsidies that distorted the usual premium versus claims loss ratios that have been historically used to determine renewals.

2021 will emphasize the importance of having a good broker and will highlight the advantages to Administrative Services Only (ASO) plans as a mechanism to keep costs inline, as using ASO will mean the plan sponsor will only pay for actual claims; not claims plus additional “utilization” assumptions that will increase premium rates.

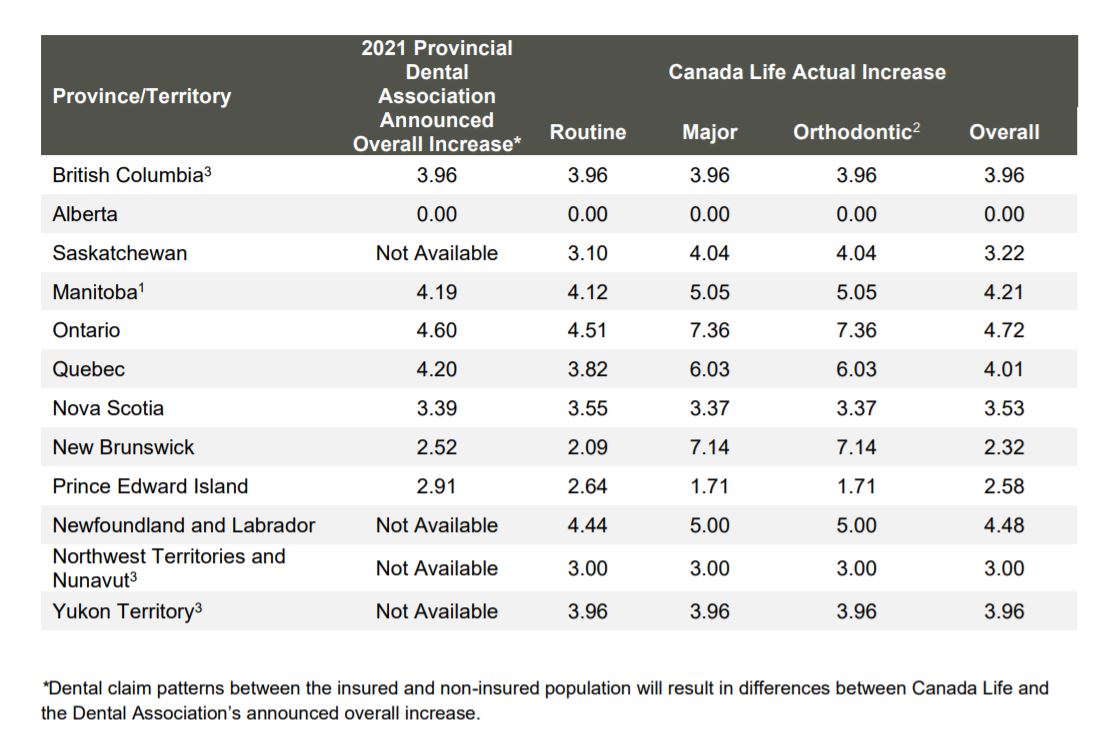

From the most recent Canada Life groupline newsletter, the following was noted:

Each provincial dental association publishes an annual fee guide. Dentists use these guides for reference when determining their own fees for the year ahead. Canada Life sets its overall dental

claim cost increases by comparing fee increases in these provincial guides with the most commonly used procedure codes from the previous year.

Impact of changes

The impact of fee changes will vary, depending how a plan is set up. ie, Plans that include an automatic fee guide update – claims incurred on or after the effective date, as set out in the following chart, will be assessed according to the 2021 provincial fee guides.